The metaverse – a virtual space in which users interact with others in a computer-generated environment – has been a hot topic since Facebook changed its name to Meta back in 2021. This signaled its ambitions span far beyond the realms of social media and put it in line with other metaverse companies expanding into the same, virtual space.

Since that announcement, a slew of companies have committed time and money to build virtual reality environments or invest in metaverse projects and initiatives, from Microsoft’s increasingly immersive video conferencing options to Adidas buying NFTs.

Companies like Meta are predicting internet users will spend increasing amounts of their time in virtual spaces in the near future, but there are still major disagreements in the tech sector surrounding the demand for more metaverse-style spaces, and its popularity in general.

What is the Metaverse?

Right now, the metaverse is a virtual space where users can interact with one another in a computer-generated environment created by a metaverse company or organization.

Some ultra-immersive multiplayer online games that have been around for years – such as Minecraft – already have several metaverse-like features and are often described as “proto-metaverse” (although some would say it’s a full-blown metaverse already).

Currently, the metaverse isn’t a singular entity or place – any company can, in theory, create a “metaverse”.

How interconnected and interoperable metaverses will be in the future, however, is hard to predict – what we call a “metaverse” now may be considered a rather primitive iteration of the concept in several years to metaverse companies leading the way now.

Tech leaders like Mark Zuckerberg and Meta want to develop the concept from where it is now to a constant, live digital universe that grants individuals agency and social presence comparable to real life.

But the economically volatile and seemingly faddish nature of NFTs and other related topics has led many to hedge their bets. Others, on the other hand, have already invested billions.

Metaverse Companies: Existing Metaverses

Decentraland

Decentraland is a virtual-reality platform and metaverse powered by the Ethereum blockchain – and one of the most well-known names in the space.

The 3D space Decentraland users operate in is called LAND. LAND is a non-fungible digital asset that is divided into parcels, which then can be owned by members of the community and purchased from each other using Decentraland’s own cryptocurrency, MANA.

Within Decentraland, users can create applications, games, and stores using any third-party 3D modeling tool before importing their creation into Decentraland’s “Builder”.

Plots of land and property in Decentraland have previously sold for millions of dollars, including one $2.4 million purchase in 2021 that was thought to be a virtual real estate record at the time.

However, in October 2022, the company confirmed there were only 56,697 monthly active users. For many, the Decentraland bubble has well and truly burst.

The Sandbox

The Sandbox is a metaverse that, like Decentraland, is based on the Ethereum blockchain. It also allows users to create and subsequently monetize digital assets, as well as game. No one owns the Sandbox outright – users own parts of it.

A LAND is a section of the Sandbox you can own and subsequently monetize depending on what you put in it. The VoxEdit editing tool allows users to create 3D objects, while The Sandbox Game Market lets users create 3D games for free.

The Sandbox has garnered investment from a variety of sources, from Snoop Dogg to the government of Dubai.

By mid-2022, The Sandbox had more than two million registered users, and Co-founder Sebastien Borget reported 350,000 monthly active users as recently as April.

Roblox

Roblox is another metaverse environment where developers build experiences, worlds, and games. In Roblox, users will create a virtual avatar that stays with them across different immersive, metaverse-based experiences.

Unlike the entirely decentralized sandbox, Roblox is centralized and exercises ultimate control over user assets and experiences and isn’t supported by the Ethereum blockchain.

Roblox was set up with a younger audience in mind than some other metaverse companies, so more attention is paid to keeping the space safe. In December 2021, Roblox CFO Craig Donato said the platform had 4,000 moderators to facilitate this.

Roblox said it had 52 million daily active users in the second quarter of 2022 and 11.3 million unique monthly players. When Roblox went public in 2021, it was valued at $45 billion.

Axie Infinity

Created by Vietnamese company Sky Mavis, Axie infinity is an NFT collecting and digital pet community game.

In Axie infinity, users can purchase and sell “Axies”, customizable creatures that can be pitted against each other in a battle for prizes – a bit like Pokemon.

Axie Infinity is more comparable to Decentraland and The Sandbox than Roblox, largely because it’s NFT-based and known for its in-game economy instantiated in the Ethereum blockchain.

According to some estimates, Axie Infinity had, almost 3 million monthly active users in late 2021, although that figure has since declined. Some recent estimates suggested the daily active user base sits at around 22,000.

Battle Infinity

Battle infinity, is a gaming and sports platform that “hosts multiple P2E [Play-to-Earn] battle games integrated with the metaverse world called ‘The Battle Arena’.

“In the Battle Infinity world”, the company says, “gamers are not only able to play and battle, but can also enjoy the immersive experience of the metaverse”.

Users can stake their holdings by depositing them for a period of time and will receive extra benefits for other activities they perform on the platform. Rewards are distributed in IBAT, which is Battle Infinity’s native token.

The IBAT Premier League is, according to Battle Infinity, “the world’s first decentralized blockchain NFT-Based fantasy sports game integrated with metaverse” where users can build their own team and battle other users.

Bloktopia

Bloktopia is a cyberpunk-inspired decentralized metaverse built using the Unity engine. The Bloktopia metaverse that revolves around a virtual reality skyscraper with 21 different levels.

Floor one is the central hub of Bloktopia, while floor 6 is where meetings, concerts, and presentations take place. Floor 21 – known as the Penthouse – is reserved for entertainment purposes only.

$BLOK is the native currency of Bloktopia and the Bloktopia ecosystem relies heavily on Play-to-Earn games, within which plans can earn fungible and non-fungible tokens.

Unity

Unity is a gaming development engine, meaning that rather than being a “metaverse” in the sense that Decentraland is, for example, Unity helps other fledgling metaverse companies and individuals build their own.

As well as its metaverse exploits, Unity already powers around 71% of mobile games and half of all PC and console games, meaning more than 2.5 billion people play games developed with the Unity engine.

Gaming is – and will likely remain – one of the most well-beaten paths into the metaverse for many teenagers and young people, so it makes perfect sense for a company like Unity to be front and center of the metaverse.

NFT Worlds

NFT Worlds is a decentralized, Minecraft-inspired metaverse project with 10,000 worlds.

The world-building aspect of Minecraft is maintained, and holders of an NFT world can offer in-game, paid experiences for other users. All transactions are tied to in-game cryptocurrency WRLD.

In May of 2022, NFT worlds broke its concurrent active players record (2,358) and surpassed 50,000 monthly active users.

Otherside

Otherside is a multiplayer online gaming experience and metaverse developed by Yuga Labs, the company behind the Bored Ape Yacht Club NFTs and ApeCoin ($APE) – which is Otherside’s native currency.

Yuga Labs want to go a step further than the average metaverses currently in development, demanding a “new frontier” for human interaction.

Users will be able to access Open data kits to build games and develop their land within the metaverse and will have their own avatars. Land in Otherside contains unique “artifacts” that cannot necessarily be created in a normal capacity.

Tech Giants Investing in the Metaverse in 2022

Meta

When Facebook changed its name to Meta, it officially became the most famous metaverse company on the planet, and interest in the general concept and topic skyrocketed.

Just before this, Meta (then Facebook) announced that it would invest $50 million into partnerships with organizations committed to building the Metaverse responsibly.

But plans had been in the pipeline long before then. For instance, Meta paid $2 billion for Oculus VR in 2014. Four years later, executive Jason Rubin claimed the metaverse was “ours to lose” in the next decade.

This year, founder and CEO Mark Zuckerberg has made a number of public statements about the company’s approach to the metaverse, including predicting that his company will make a loss on projects in the near term.

However, he revealed back in June 2022 that Meta wants around “one billion people” to be active in the metaverse. Also this year, Meta opened the company’s first VR headset store, and more recently, in September 2022, the company’s latest VR hardware, the Meta Quest Pro, went on sale. You can use this and other Meta VR gear to explore Meta’s Horizon Worlds.

Microsoft

Microsoft is different from many other metaverse companies with its focus on developing work-based metaverse environments – most notably Microsoft Mesh.

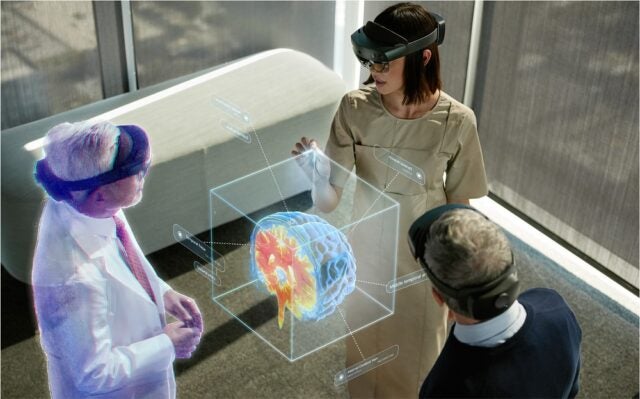

Rather than focus specifically on gaming, the company defines its metaverse exploits as “the ability to bridge the digital and the physical worlds.”

Mesh – which was designed to integrate into Microsoft Teams – is a mixed-reality overlay that facilitates immersive collaboration in virtual spaces for teams, and can be accessed via mixed-reality glasses and VR headsets.

Microsoft’s acquisition of social VR platform AltspaceVR in 2017 with the explicit purpose of using its intellectual property for Mesh, illustrates just how long their metaverse plans have been in the pipeline. AltSpace recently announced it would be closing for good, with Microsoft shifting even more of its focus onto developing Mesh.

However, Microsoft’s decision to acquire gaming company Activision in January – at the time the priciest tech acquisition ever made – has been suggested by some to be partly motivated by a desire to build up its gaming infrastructure for other metaverse projects.

It just has to stop Meta pinching their top metaverse minds, and then it’ll have a good recipe for success.

Google’s waded infamously (and perhaps naively) into the world of virtual/augmented reality in 2014 with Google Glass. It didn’t take long, however, for the project to be considered a resounding failure thanks to technical glitches, privacy concerns, bad marketing, and general clarity over why it existed.

However, that doesn’t mean the company is shying away from getting involved in the metaverse in 2022 – or building another pair of AR glasses. What’s more, this year, Google announced it was setting up a $39.5 billion private equity firm set up to exclusively fund metaverse projects.

What projects are on the horizon for the Alphabet subsidiary is not public knowledge, but with a fund that large, expect big things to come from Google.

Nvidia

Nvidia has “always understood from the beginning that we’re not just a chip company,” Rev Lebaredian, vice president of Omniverse and simulation technology at Nvidia, says, addressing the fact that, until recently, many may not think it a metaverse company.

Recently, NVIDIA announced its first infrastructure-as-a-service offering, the NVIDIA Omniverse Cloud, a suite of cloud services for development teams and artists to create and operate metaverse apps – metaverse-as-a-service if you will.

RIMAC Group, WPP, and Siemens have all already used the Omniverse technology Nvidia provides to build virtual environments, as have PepsiCo and Amazon.

Epic Games

Epic Games is most famous for being the company behind Fortnite, one of the most popular games of all time, surpassing one million players within 24 hours of release.

In April, the company raised $2 billion of investment from Sony Group Corporation and Kirkbi, the company that owns the LEGO Group – which helped raise the company’s valuation to $31.5 billion.

“This investment will accelerate our work to build the metaverse and create spaces where players can have fun with friends, brands can build creative and immersive experiences and creators can build a community and thrive,” Epic Games CEO Tim Sweeney said at the time, confirming that Epic Games want to compete with the top metaverse companies.

Epic Games also has metaverse infrastructure in place with “Unreal engine”, an extremely popular 3D graphic engine, and MetaHumans, a digital twin rendering software that can be used to generate metaverse avatars.

Animoca Brands

Animoca Brands owns the metaverse platform The Sandbox, discussed earlier on in this article, and is also collaborating with Yuga Labs on Otherside.

Animoca Brands may not be as big or as well known as some of the other companies listed in this section of this article, but they’re extremely important in the context of the metaverse. The metaverse company has a variety of different blockchain gaming projects and metaverse companies it currently supports, including Axie Infinity creators Sky Mavis.

In September 2022, it raised another $110 million for investment into metaverse products and projects. This comes after $75 million was raised in July and an even larger sum of $358 million in January this year.

Other Companies Investing in the Metaverse

Nike

Nike went all in on the metaverse in 2021, creating Nikeland inside Roblox and becoming one of the most notable corporations to invest heavily in a virtual environment.

As of September 2022, nearly 21 million people had visited Nikeland, suggesting the decision to build a world inside Roblox was a good one.

Nike’s digital results – which now include revenues made from selling digital products like NFTs in Nikeland – make up 26% of the company’s overall revenues.

Walmart

Walmart is taking a similar approach to Nike, teaming up with Roblox to create two metaverse experiences: Walmart land and Walmart’s Universe of play.

The retail company confirmed itself as an official metaverse company with the promise of a virtual music festival, games, and virtual merchandise that mimics what customers will find in Walmart stores.

The recent announcement follows reports in January of this year that Walmart quietly filed several new trademarks that suggested it was soon planning to sell virtual goods.

Adidas

While there is no “Adidas land”, Adidas has ventured into the realm of the metaverse with their first NFT products that were announced in December 2021.

Within a few hours of being on sale, 30,000 NFTs had sold and made the company somewhere in the region of $22 million.

To do this, Adidas teamed up with the Bored Ape Yacht Club, PUNKs Comic, and gmoney.

PepsiCo

Pepsi has done a little bit of everything when it comes to the metaverse. Like Adidas, they are one of the multi-national corporations that have jumped on the NFT hype, and reports from May 2022 highlight the company’s investment in metaverse real estate.

Pepsi also threw an entirely virtual concert in China in July 2022, within which a virtual band called SHANE FU – which Pepsi created – debuted their first song.

How to Invest in the Metaverse

According to Verified Market Research, the metaverse as a sector will be worth more than $800 billion by 2030, but other research has concluded that figure may be higher.

Remember: the Metaverse is not one single, digital space – it’s a collection of spaces built and sustained by a variety of different entities, metaverse companies, organizations, digital currencies and players.

One thing you could do is invest in a cryptocurrency that operates as a native currency for a metaverse space, such as $BLOK does for Bloktopia or IBAT for Battle Infinity.

The Sandbox (SAND), Decentraland (MANA), and various other metaverse companies have their own digital currencies (denoted in brackets prior) too. If you pick the right platform, one that’s getting a lot of buzz, your crypto may increase in value as more people join the platform. However, selecting the right platform is hard, and there isn’t a straight line between the size of a metaverse’s user base and the value of tokens.

Investing in cryptocurrency and NFTs does come with elevated risk, – they’re both quite volatile assets, and predicting what value they will hold over time is very difficult.

Alternatively, you could invest in companies that are big players in the metaverse space and publicly listed on the stock exchange, like Meta and Nvidia.

By keeping your ear to the ground for news on what they’re developing and when they’re releasing it, you can ensure you buy at the right time.

Is the Metaverse Already in Decline?

Although there is still a huge amount of investment being pumped into metaverse projects by some of the world’s most powerful and influential tech companies, it would be false to claim that the hype the concept garnered a year or so ago has been fully sustained. The stats suggest it isn’t going quite the same way as, say, the pandemic-induced video conferencing boom, which seems to have a bit more staying power.

According to recent reports, Meta shares are down 62% so far this year, and the company’s Horizon Worlds game is failing to live up to expectations. Dencentraland’s MANA token is off 81% year-to-date, and the active user bases of several platforms are being called into question.

Projections for the near future still remain pretty rosy for metaverse investors – Gartner predicts that we’ll spend at least one hour a day in the metaverse by 2026. But not everyone is confident we’ll be able to spend long periods of time in virtual environments without feeling queasy.

Amid economic strife, it’s becoming increasingly hard to predict the fate of metaverse companies and the ecosystem of virtual environments they’ve recently built.

Decentraland’s decline, for instance, doesn’t bode well for the metaverse, but Facebook’s Oculus Quest 2 headset surpassed the number of Microsoft Xbox Series X and S lifetime sales – and it’s closing in on Sony’s Playstation 5 – which suggests the opposite.

What could easily collapse – and should be the genesis for cautious investment – is the current ecosystem of metaverse companies working on projects. Large companies with various revenue streams like Meta could scrap them, whilst smaller companies might shut down.

What is unlikely to change is the broad idea that, as a civilization, we’re going to spend increasing amounts of time in digital spaces.

But they will need to be sufficiently immersive and collaborative, both from an entertainment and work perspective, to make it worth our time.